ev tax credit 2022 texas

Tesla No Longer Needs the EV Tax Credit. Texas offers numerous incentives and big savings to entice residents to go greenThese include emissions test exemptions for electric cars new and used vehicle rebates for natural gas vehicles plug-in electric vehicle PEV charging station rebates emissions-related repair grants alternative fuel vehicle AFV rebates fuel-efficient auto insurance discounts and more.

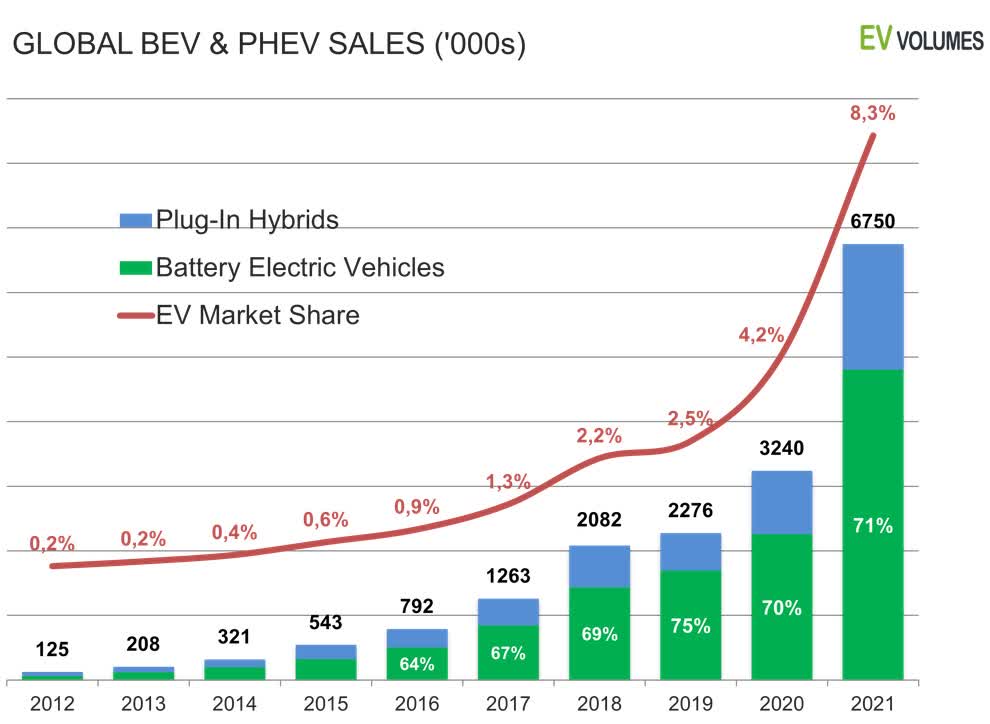

What To Expect In 2022 For Global Electric Vehicle Sales Seeking Alpha

You may submit your application via email to TERPapplytceqtexasgov or by mail to one of the addresses below on or before 500 pm CT January 7 2023.

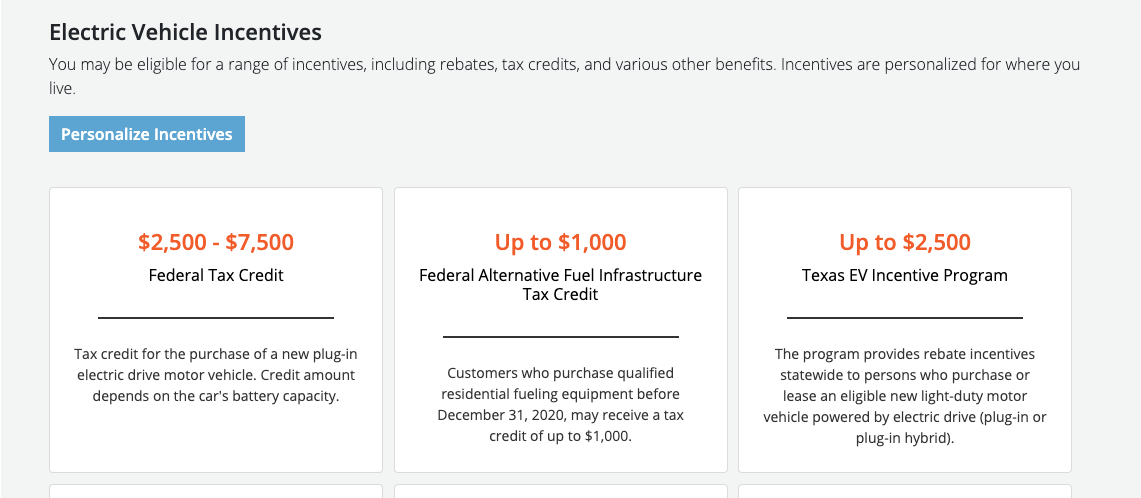

. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. The 2022 Tax Credit Phaseout for Toyotas EV and Plug-in Hybrids is Coming Soon. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Several months later it seems that revisions to the credit are returning to lawmaker agendas. The size of the tax credit depends.

Tesla Getting Ready for Cyber Rodeo in Giga Texas. 250 rebate and a tax credit for 30 of installation costs. Dual-Motor AWD 6 to 10 months 2022 Model S Plaid 4 to 8 weeks Model 3 RWD 5 to 9 months 2022.

As Toyota reaches its market cap of 200000 Prius Primes and RAV4 Primes being sold the 2022 EV Tax credit will. 50 of purchase and installation costs up to 500. Department of Transportation announced Thursday that Texas is eligible to receive 60356706 for electric vehicle EV charging infrastructure in fiscal year 2022 with 407774759 available over the lifetime of Infrastructure law funding.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. The credit ranges between 2500 and 7500 depending on the capacity of the battery. From 2020 you wont be able to claim tax credits on a Tesla.

Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. Southwestern Electric Power Company. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Texas EV Rebate Program 2000 applications accepted per year. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

Safety agencies and consumer groups warn about Tesla Vision in the Model 3 and Model Y. Lets say you owed the federal government 10000 in taxes when filing your 2021. Regular Post Delivery Texas Commission on Environmental Quality Air Grants Division LDPLIP MC-204 PO.

Texas doesnt budge for Tesla. January 1 2020 to December 31 2022. The State of Texas offers a 2500 rebate for buying an electric car.

Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners. January 1 2023 to December 31 2023.

After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. Express Delivery Texas Commission on Environmental Quality. If your new EV qualifies for a government tax rebate you may be eligible for a federal income tax credit of up to 7500.

IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500. On or after January 1 2024. The base minimum credit is increased to 5000 in 2026 Senate version or 4000 in 2022 House version.

Then from October 2019 to March 2020 the credit drops to 1875. Which EVs Hybrids Qualify. The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance.

Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers. As it stands now the current EV tax credit gives a base amount of 2500 for a four-wheel vehicle propelled by a battery at least a 4 kWh battery and is charged by an external source ie plug-in. The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive.

The reason is that once a car manufacturer sells its 200000th vehicle the credit is reduced being cut in half to 3750 is then halved again after a period and then finally phased out. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Texas Solar Incentives Tax Credits Rebates Sunrun Tax Credit For Electric Vehicle Chargers Enel X Latest On Tesla Ev Tax Credit January 2022 Tips For Electric Vehicle Drivers In Texas. And will Americans be able to get up to 12500 with a re-upped EV tax credit.

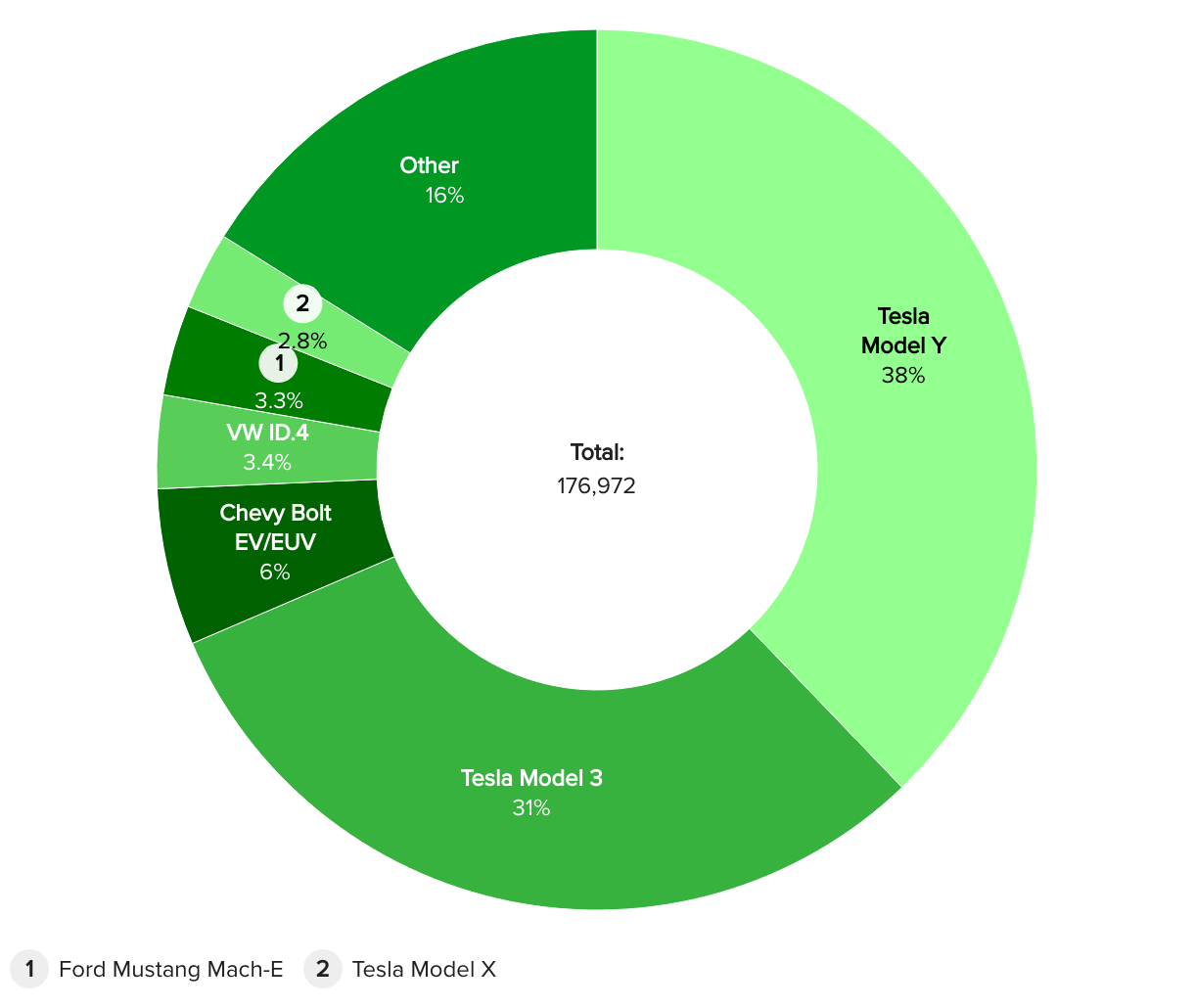

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The US Federal tax credit is up to 7500 for an buying electric car. 2022 Electric Vehicle Tax Credits.

Here are the currently available eligible vehicles. Updated March 2022. Federal Tax Credit 200000 vehicles per manufacturer.

The federal Internal Revenue Service IRS tax credit is for 2500 to 7500 per new EV purchased for use in the US. This is the largest sum awarded to any state. You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV.

Box 13087 Austin TX 78711-3087. The credit amount will vary based on the capacity of the battery used to power the vehicle. AUSTIN Texas -- The US.

Ev tax credit 2022 texas Sunday February 13 2022 Edit. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

Federal Solar Tax Credit 2022 How It Works How Much It Saves

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

Latest On Tesla Ev Tax Credit March 2022

Tips For Electric Vehicle Drivers In Texas

Electric Car Tax Incentives And Rebates Reliant Energy

Tax Credit For Electric Vehicle Chargers Enel X

Texas Solar Incentives Tax Credits Rebates Sunrun

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Latest On Tesla Ev Tax Credit March 2022

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Latest On Tesla Ev Tax Credit March 2022

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Tips For Electric Vehicle Drivers In Texas

Tips For Electric Vehicle Drivers In Texas

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek